Smartphones have become an integral part of our daily lives, serving as our go-to devices for communication, productivity, entertainment, and much more. With each passing year, smartphones continue to evolve, incorporating new features and innovations that enhance their capabilities and redefine the user experience. In this article, we’ll explore the latest trends and advancements in smartphone technology, highlighting how smartphones are evolving to meet the needs of modern consumers.

Introduction of Foldable Displays

One of the most significant advancements in smartphone technology in recent years is the introduction of foldable displays. Foldable smartphones feature flexible screens that can be folded or unfolded to transform the device from a traditional smartphone form factor into a larger tablet-like display. This innovative design allows users to enjoy the portability and convenience of a smartphone while also benefiting from the larger screen real estate for tasks such as multitasking, gaming, and multimedia consumption.

Foldable smartphones come in various form factors, including clamshell designs and book-style folds, offering users different options to suit their preferences and usage scenarios. While foldable smartphones are still relatively niche and come with a premium price tag, they represent a glimpse into the future of smartphone design and form factor innovation.

Advancements in Camera Technology

Camera technology has been a focal point of smartphone innovation, with manufacturers constantly pushing the boundaries of what’s possible in mobile photography and videography. The latest smartphones are equipped with advanced camera systems featuring multiple lenses, high-resolution sensors, and sophisticated image processing algorithms, allowing users to capture stunning photos and videos in any environment.

One of the notable trends in smartphone camera technology is the integration of periscope-style zoom lenses, which enable smartphones to achieve impressive levels of optical zoom without sacrificing image quality. Additionally, advancements in computational photography techniques, such as night mode and AI-powered scene recognition, have further improved the quality of smartphone photos, allowing users to capture clear and detailed images even in low-light conditions.

5G Connectivity and Beyond

The rollout of 5G technology has ushered in a new era of connectivity, promising faster download and upload speeds, lower latency, and greater network capacity. Smartphones with 5G support enable users to experience blazing-fast internet speeds and seamless connectivity for streaming, gaming, video conferencing, and other bandwidth-intensive tasks.

Looking ahead, the evolution of smartphone connectivity extends beyond 5G, with the development of technologies such as satellite communication and terahertz wireless communication. These advancements aim to further enhance global connectivity and bridge the digital divide by providing reliable internet access to underserved communities, remote areas, and maritime environments.

Enhanced Security and Privacy Features

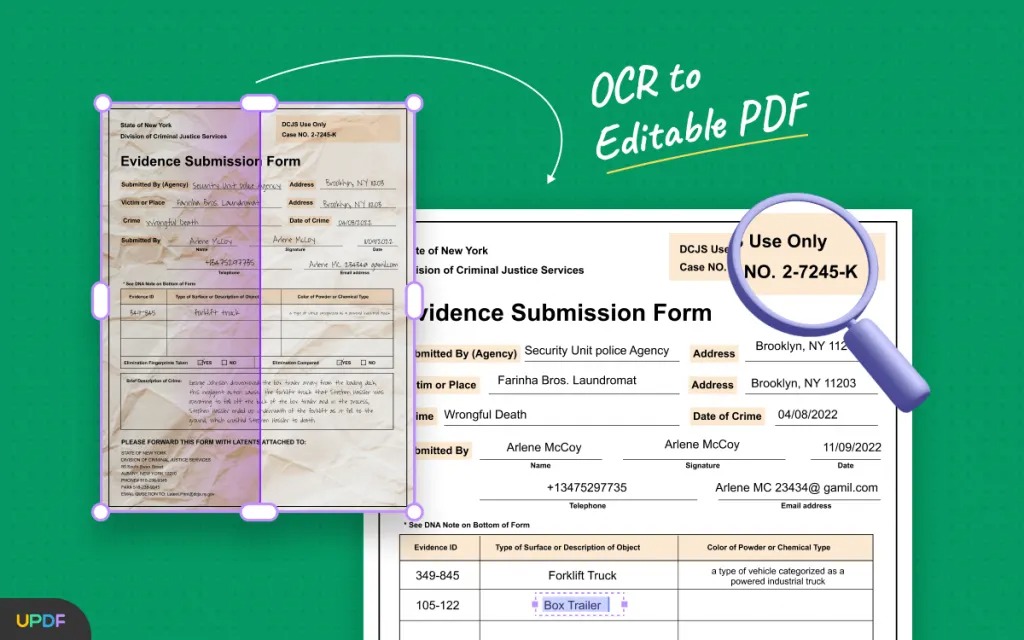

As smartphones increasingly store sensitive personal and financial information, ensuring the security and privacy of user data has become a top priority for manufacturers. The latest smartphones feature enhanced security features such as biometric authentication (e.g., fingerprint scanners, facial recognition) and hardware-backed security modules to safeguard user data against unauthorized access and cyber threats.

In addition to security features, smartphones are also incorporating privacy-focused features such as app permissions controls, location tracking transparency, and enhanced encryption protocols. These features give users greater control over their data and help protect their privacy in an increasingly connected world.

Conclusion

In conclusion, smartphones continue to evolve at a rapid pace, incorporating new features and innovations that redefine the way we communicate, work, and play. From foldable displays and advanced camera systems to 5G connectivity and enhanced security features, the latest smartphones offer unprecedented capabilities and versatility. As technology continues to advance, we can expect to see even more exciting developments in smartphone technology, further enriching the user experience and shaping the future of mobile computing.